NOI '98 P1 - Personal Income Tax

View as PDFNational Olympiad in Informatics, China, 1998

A country's income tax law regulates citizens' personal income taxes to be based on their wage and income.

Wage taxation is calculated on a monthly basis. dollars worth of

fees are subtracted from one's total monthly wage, and the result is used

as the base amount from which their personal income tax is calculated.

The tax rate is outlined in the following table:

| Bracket | Base Amount Range (Each Month) | Tax Rate (%) |

|---|---|---|

| 1 | No more than |

|

| 2 | More than |

|

| 3 | More than |

|

| 4 | More than |

|

| 5 | More than |

|

| 6 | More than |

|

| 7 | More than |

|

| 8 | More than |

|

| 9 | More than |

Income taxation is calculated independently, and separately for each payout

instance. For each payout, if the amount does not exceed dollars,

then

dollars of fees is taken away to get the base amount. If the

amount exceeds

dollars, then

of that is subtracted to yield the

base amount. The base amount is then used to calculate the income tax

rate.

| Bracket | Base Amount Range (Each Payout) | Tax Rate (%) |

|---|---|---|

| 1 | No more than |

|

| 2 | More than |

|

| 3 | More than |

From the above, one should realize that both wage and income taxes are to be calculated in a compounded fashion. That is, one must start at the first income bracket and pay as much of that given range as possible according to the rate specified in the bracket. If there is money left over (their current amount exceeds the base amount range), then they move down to the next income bracket, where they apply as much of the excess amount as they can. This continues until they have exhausted all of the value.

For example, an individual's wage for one month is dollars. After

subtracting

dollars of fees, they apply the remaining

dollars

to each of the income brackets. Bracket 1 is completely filled with

dollars, bracket 2 is completely filled with

dollars, and bracket 3

gets the remaining

dollars. The rates applied to the brackets are

respectively

,

, and

. Thus the total wage tax for that month is

(dollars).

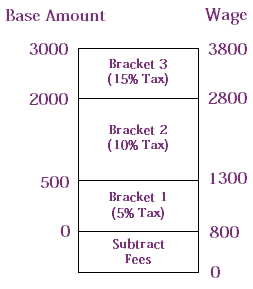

The calculating process is outlined in the figure given on the left.

You must write a program to help a company keep track of the taxes they have to pay for one year, given the information of all of their payouts (the type of payout, time of payout, and the amount paid). Your program must find the sum of both the wage tax and income tax for all of their employees.

Input Specification

The first line of inputs contains one integer

, the

number of employees in the company. The remaining lines each describe

the information for one payout instance. There are two possible formats:

- Wage tax payout:

PAY ID Date Amount - Income tax payout:

INCOME ID Date Amount

Here, ID represents the ID of the employee being paid (an integer from

1 to ),

Date is the date of the payout in the format MM/DD where

MM is the month

MM ,

DD is the day

DD ,

and

Amount is the amount paid in dollars (assume that each

amount is a positive integer no larger than 1 million).

A line with the character # denotes the end of input. Adjacent

values in the input will be separated by one or more spaces.

Output Specification

The output contains a positive number , the total amount of tax (wage

and income) that the company must pay on behalf of all of its employees

for that year in dollars. This value must be rounded and displayed to 2

decimal places.

Sample Input

2

PAY 1 2/23 3800

INCOME 2 4/8 4010

INCOME 2 4/18 800

PAY 1 8/14 6700

PAY 1 8/10 1200

PAY 2 12/10 20000

#Sample Output

5476.60Problem translated to English by .

Comments